“Those who fail to learn from history are doomed to repeat it.” – Sir Winston Churchill

“Mitchell: VAT Increase Unconscionable” – The Bahama Journal

Excerpt from this article; “According to Senator Fred Mitchell, fifty percent of the people who make under $30,000 a year in The Bahamas cannot makes ends meet at the end of the month.

The Leader of the Opposition in the Senate made it clear that he supports the government’s spending, but part ways on its push to impose a 12 per cent Value Added Tax.

‘It just seems counter-intuitive and unconscionable’, he said.”

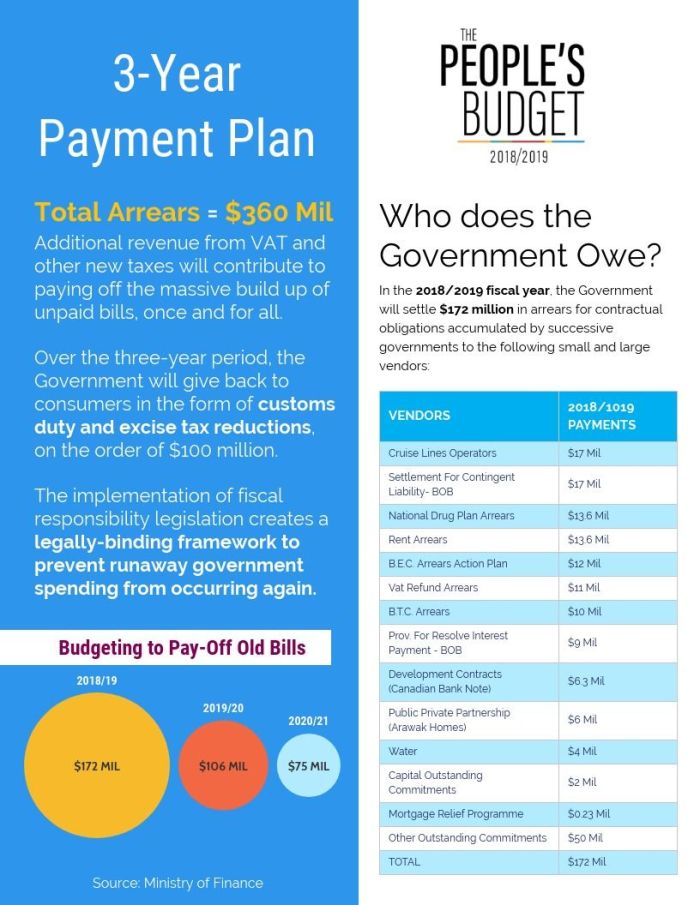

Since it has been announced that the rate of value-added tax (VAT) would be increased by 4.5 percent, to 12%, many persons have taken the current administration to task on imposing such a burden in the backs of the ‘poor man’ but very little have questioned as to how we got to this point and to forget our past history and not learn from it is one of the most serious mistake that we can make as a nation.

Senator Mitchell says supports the government’s spending but ‘part ways’ on its push to impose a 4.5 percent increase to the rate of VAT, so basically the Progressive Liberal Party (PLP) Senator and Chairman is saying that he and his party consents to continued borrowing; increased national debt and increased deficit without a plan to actually reduce them – indeed the man is ‘mad’ and anyone else that supports his position, as he wants to make an omelet without breaking a few eggs; pure insanity and how we got to this point in the first place.

Simply put, you CANNOT continue to borrow without a way/plan of actually paying it back.

In November of 2016 it was reported that the government had collected almost a billion dollars from value-added tax (VAT); if this was the case and the money was actually out into the consolidated fund, as the story goes, what happened? What eventually happened to it because during this time the country’s economy had been downgraded at least once maybe even twice?

We all know that they say that hind sight is 20/20, and looking back now Senator Mitchell sight will be 20/20 , because while we will all agree that the country was in dire need of another source of revenue to offset the country’s borrowing and to pay its bill some could make the argument that it was “unconscionable” to introduce in the first place, if you were to apply the senator’s standards at to what is “unconscionable” but the simple fact that the funds collected not seemingly to have been used for the purposes that they were collected is what is really “unconscionable”, in my opinion but will Senator Mitchell admit to this, in hindsight?

In the fiscal year 2016/2017 when the government was set to borrow just under $100 million to cover the projected budget deficit; $30 million more than the Progressive Liberal Party (PLP) administration had actually projected at the beginning of the 2016/2016 fiscal year; didn’t bells go off that maybe, just maybe ‘something’ was wrong? And I ask the PLP administration at the time to not blame Hurricane for this “miscalculation”, because an additional $150 million was subsequently borrowed after this storm and by the way, wasn’t VAT supposed to have been waived in the event of a natural disaster?

The truth of the matter is that the former administration never actually met any of its financial targets but now seeks to label the present measures as “unconscionable”; what is actually “unconscionable” is anyone in the former Progressive Liberal Party (PLP) administration criticizing anything to do with the present budget.

END