“Mitchell applauds FNM VAT rebels” – The Nassau Guardian

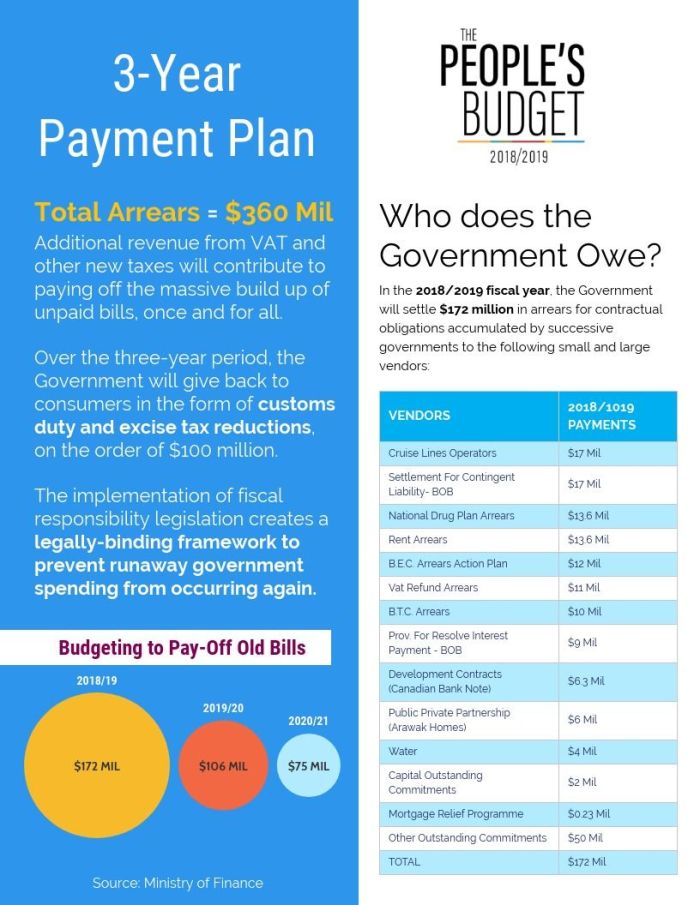

Excerpt from this article; “Progressive Liberal Party (PLP) Chairman Fred Mitchell yesterday applauded the four government MP’s who voted against the value-added tax (VAT) increase in parliament early Tuesday morning.

Bain and Grants Town MP Travis Robinson, Golden Isle MP Vaughn Miller, Pineridge MP Fredrick McAlpine and Centerville MP Reece Chipman all voted against the bill to increase Vat from 7.5 percent to 12 percent.

First of all is a vote that should have been condemned because what happened was against the advice of the views of the business community and against the views of the people at large,’ Mitchell said in an interview with the Nassau Guardian.”

It is indeed interesting that now the chairman of seems to want to cash in on this current situation given his past when he and his very own parliamentary colleagues seemed unable to show any form of moral conviction or courage when they served the people of The Bahamas as the government; the debacle of the Gaming referendum is prime example of this because while the people said NO, the government of the time, of which Senator/Chairman Mitchell was a member of parliament and Cabinet Member who sat silently as the Progressive Liberal Party went against the voice of the people but to be fair Mr. Mitchell he may not have even been in the country at the time.

My point: Senator/Chairman Mitchell’s opinion of this matter and the persons involved carries as much weight as a sieve carries water and represents an opinion best kept to himself, as he goes on to show his duplicitous hypocrisy in this matter; “And not just to vote with the PLP but vote no the principle that the tax is wrong, and I think that they ought to be applauded for having stood up for that.” But where was Senator Mitchell when the people said that the original implementation of values-added tax (VAT) was wrong?

Did it just become wrong?

Why should his opinion matter at all?

Personally, while I understand the position on which these four members of parliament claim to have stood, they should also realize that because of our system of governance there would be consequences. I bear no ill will or have any bad words for these men; they voted their conscience and/or represented the voices of their constituents.

END